Kris Morgan, post: 386863, member: 29 wrote: [USER=188]@Glenn Breysacher[/USER] "You said "If one dedicates something to the public, it's gone, regardless if the body representing the public accepts it." That's not true. For example, someone can dedicate an easement to the public for utilities, and it can lie dormant for years without improvement, maintenance, or use (usually the three areas of evidence of acceptance)."

Well, I suppose, you may be right, but, in your example, if the easement is dedicated by the plat, then the easement exists and will show up as an encumbrance upon the tract, by a title company, until such time as the easement is extinguished by plat vacation or some other action. If it was recorded in the court house as a metes and bounds, regardless of whether the utility gets installed, it is still the encumbrance on the tract. So it's dedication and filing make it exist, whether it was accepted remains to be seen. There are provisions in the law, regarding inactivity of easements, specifically pipelines, that will void an easement, but not roads, even though it is an easement of sorts. It's dedication of a road, to the public, removes it from a use of a company or individual and then places it in the realm of the people, which, as the maxim goes, once a road, always a road. Obviously there are some exceptions to this, but by and large, a corridor created for public travel, and dedicated to the public as such, will remain that way.

We have many old subdivisions where the roads were never built, but the plat dedicated the area for a road. For the city, we have an abandonment vehicle and for the county, we vacate the plat in part, specifically the roads and have an abandonment for those roads as well to clear title and remove the burden.

Kris,

I think we are saying essentially the same thing. Yes, you are correct that if shown on a plat, or even a filed separate instrument, that easement will show up as an encumbrance until extinguished by the appropriate action. However, acceptance is another issue. You know and I know, the title company will be conservative and catch/list any possible dedication in their title commitment, and don't investigate the acceptance. They assume every encumbrance to have been accepted unless the contrary can be shown. To be quite frank with you, the governmental entity can, in some cases, argue either side, accepted or not accepted, if they so choose.

As far as a roads are concerned, I still hold that the same can be shown to be true regarding acceptance. Improvements, use, & maintenance are all considered evidence of acceptance. In some cases, you may not have to provide evidence of all three. In practice, most people assume that since it was on a subdivision plat, it must have been accepted and will exist for eternity, even without the evidence of improvements, use, or maintenance. Not necessarily.

Glenn Breysacher, post: 386881, member: 188 wrote: However, acceptance is another issue

Can you post an example of a separate doc metes and bounds easement agreement? I've attached one from a job I'm currently working on. It's between two private parties but it would read almost identically if it were being granted to a jurisdiction. There is a grantor and a grantee. Both have to sign it for it to be enforceable and the subsequent act of recording it into the public record is the simultaneous dedication and acceptance between the grantor and grantee. In Texas can this type of document be recorded without a grantee? Why would anyone dedicate an easement that no one wanted thus encumbering their property for no reason?

Glenn Breysacher, post: 386881, member: 188 wrote: Kris,

I think we are saying essentially the same thing. Yes, you are correct that if shown on a plat, or even a filed separate instrument, that easement will show up as an encumbrance until extinguished by the appropriate action. However, acceptance is another issue. You know and I know, the title company will be conservative and catch/list any possible dedication in their title commitment, and don't investigate the acceptance. They assume every encumbrance to have been accepted unless the contrary can be shown. To be quite frank with you, the governmental entity can, in some cases, argue either side, accepted or not accepted, if they so choose.

As far as a roads are concerned, I still hold that the same can be shown to be true regarding acceptance. Improvements, use, & maintenance are all considered evidence of acceptance. In some cases, you may not have to provide evidence of all three. In practice, most people assume that since it was on a subdivision plat, it must have been accepted and will exist for eternity, even without the evidence of improvements, use, or maintenance. Not necessarily.

We have an interesting situation with a client whose access is via a dedicated street in a subdivision recorded circa 1940. The street is shown as 40 feet in width. No road of any sort was ever constructed, and no one questions that no vehicle has ever traveled down it. Due to the use they have planned for the property the County require a fully improved "standard county road." which requires a 60' corridor. Such a thing cannot be constructed in a 40' strip, but the County has demanded it anyway. The property owners in the subdivision are opposed to the new owner's plans, so they will not sell strips along the dedicated street to widen it. The project has come to an impasse, the new owner has consulted with a very expensive attorney way up on a high floor in a tall, tall building and been told he is out of luck! They have legal access, but can't develop the property - due diligence can be extremely important!

Jim in AZ, post: 386864, member: 249 wrote: My biggest question is when in the process does the property actually change hands and is no longer taxed

I am in Texas, and I own to the middle of the county road, and I pay taxes on that land. The legislature passed a bill a few years back that allows for landowners in Texas to have property covered by county roads to be taken off their tax burden, but I figured it wasn't worth the trouble. The road in this case is one of the oldest roads in the county, laid out along the section lines.

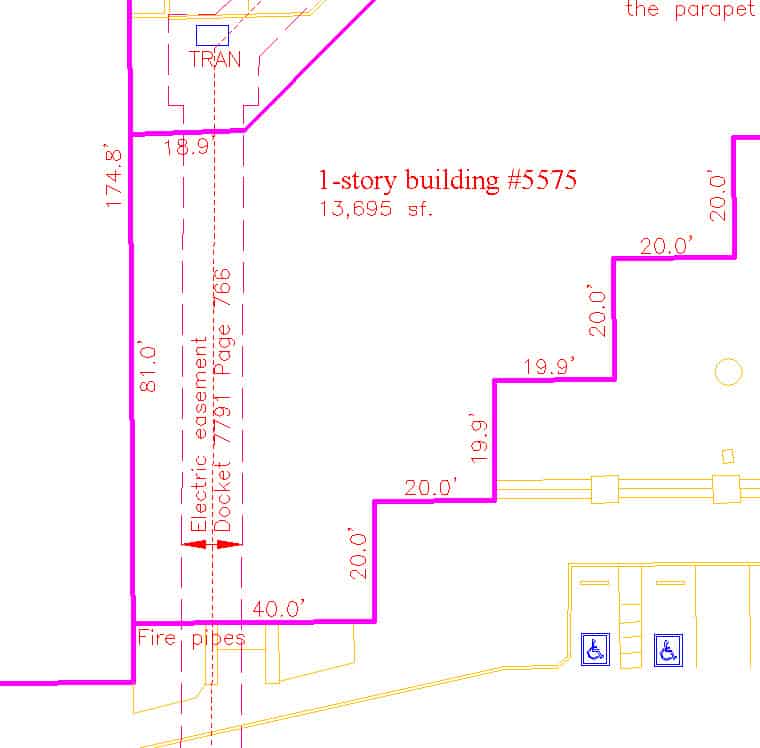

Here is an example of an obvious encroachment of a building over an electric easement, where the attorneys for the lender had a fit. Except it isn't an encroachment. When it was built all of the parties involved knew in advance that the building would be constructed over the easement, which is why the electric duct work was encased in concrete. I knew that because we did the surveying and I wrote the easement.

FYI, from the Texas Local Government Code, Chapter 212:

Sec. 212.011. EFFECT OF APPROVAL ON DEDICATION. (a) The approval of a plat is not considered an acceptance of any proposed dedication and does not impose on the municipality any duty regarding the maintenance or improvement of any dedicated parts until the appropriate municipal authorities make an actual appropriation of the dedicated parts by entry, use, or improvement.

(b) The disapproval of a plat is considered a refusal by the municipality of the offered dedication indicated on the plat.

Monte, post: 386913, member: 11913 wrote: I am in Texas, and I own to the middle of the county road, and I pay taxes on that land. The legislature passed a bill a few years back that allows for landowners in Texas to have property covered by county roads to be taken off their tax burden, but I figured it wasn't worth the trouble. The road in this case is one of the oldest roads in the county, laid out along the section lines.

Ownership to centerline of County roads is very common here. We do not have the availability of removing anything from the tax rolls, however.

Jim in AZ, post: 388702, member: 249 wrote: Ownership to centerline of County roads is very common here. We do not have the availability of removing anything from the tax rolls, however.

If you own to the center of a ROW, you might want your acreage to include that as far as needing a minimum tract size for certain purposes (say a well, where there is some regulation that requires you to have a minimum of 5 acres). The tax rolls should reflect the part of your property that is occupied by the roadway, is worth virtually nothing, and that should lessen the value of that part of your property since you virtually can't use it for any practical purpose. (I say should...but I have no clue whether the assessor takes that into account.

[USER=11913]@Monte[/USER]

Cass County does not comply with that law, claim that the decision is theirs to make.

A few clients with hundreds of acres of land within roads are complaining.

Tom Adams, post: 388705, member: 7285 wrote: If you own to the center of a ROW, you might want your acreage to include that as far as needing a minimum tract size for certain purposes (say a well, where there is some regulation that requires you to have a minimum of 5 acres). The tax rolls should reflect the part of your property that is occupied by the roadway, is worth virtually nothing, and that should lessen the value of that part of your property since you virtually can't use it for any practical purpose. (I say should...but I have no clue whether the assessor takes that into account.

Not here! I'm not sure that the Assessor doesn't increase your taxes if you have a County road running through your property!

Jim in AZ, post: 388709, member: 249 wrote: Not here! I'm not sure that the Assessor doesn't increase your taxes if you have a County road running through your property!

Probably not anywhere, Jim. I bet that they just look @ the acreage on the deed (or somewhere) to assess the tax value. All I'm saying is that the part of the property in public R/W should be valued less.

Tom Adams, post: 388711, member: 7285 wrote: Probably not anywhere, Jim. I bet that they just look @ the acreage on the deed (or somewhere) to assess the tax value. All I'm saying is that the part of the property in public R/W should be valued less.

Areas in public rights of ways here can be moved from taxes as "waste lands" but you have to request it, they wont remove it automatically

Tom Adams, post: 388711, member: 7285 wrote: Probably not anywhere, Jim. I bet that they just look @ the acreage on the deed (or somewhere) to assess the tax value. All I'm saying is that the part of the property in public R/W should be valued less.

I certainly agree with that Tom - you really can't use it for anything, so why should you be taxed? Of course I am a Libertarian and don't agree with anything that Government does... 🙂

I believe in Iowa it is automatic that the road is subtracted and you are taxed on net acres.

It is counted in your total acres here, but the taxable acres are reduced to not include those effectively lost to road right-of-way.

Gross and Net acreage here. Gross for zoning, net for setbacks.

Stae code says to call it an "Apparent Encroachment" So that's what I do.

Sec. 20-300b-2. Property/Boundary and Limited Property/ Boundary

Surveys(a) Property/Boundary and Limited Property/Boundary Surveys require sufficient investigation, study, field measurement and evaluation of factors affecting boundaries, real property interests and other relevant matters with respect to the subject real estate to enable the surveyor to render a professional opinion as to boundary locations and any conflicts therewith.

These surveys require the preparation of a detailed field survey and are intended to present the surveyor's property/boundary opinion. It is

recognized that certain factors pertaining to boundary line determination are beyond the surveyor's purview and may require agreements between abutting property owners or action by the courts.

Facts surrounding such circumstances shall be noted.

(b) Types of Property/Boundary Surveys

(1) Property Survey A Property Survey is a type of survey intended to depict and/or note the position of boundaries with respect to:

(A) locations of all boundary monumentation found or set;

(B) apparent improvements and features, including as a minimum:

dwellings, barns, garages, sheds, driveways, roadways, surface utilities, visible bodies of water and swimming pools;

(C) record easements and visible evidence of the use thereof;

(D) record and apparent means of ingress and egress;

(E) lines of occupation, including as a minimum: fences, walls, hedges

and yards;

(F) deed restrictions pertaining to the location of buildings or other

apparent improvements;

(G) unresolved conflicts with record deed descriptions and maps;

(H) all apparent boundary encroachments; and

(I) monumentation required to be set at all corners created by a

deflection angle of not less than 70 degrees between two consecutive

courses and at intervals not to exceed 600 feet along the boundaries

between said corners, except where natural or man-made monumentation.

[USER=11913]@Monte[/USER]

Cass County does comply with that law.

According to their way of reading, it is up to them to tax or not.

They are always doing whatever to increase the tax rates.

😡

Joe the Surveyor, post: 388756, member: 118 wrote: Stae code says to call it an "Apparent Encroachment" So that's what I do.

If there is a right-of-way easement, would it still be an encroachment?

Cameron Watson PLS, post: 386846, member: 11407 wrote: Okay, so I'm starting to understand your process and I think our mileage does vary. If the method is via plat where you are then it goes like this:

1. private party creates a plat, shows ROW and includes dedicatory language

2. plat goes through some governmental review process and gets approved for recording (all parties signing final version)

3. plat gets recorded into the public record

[this is where I'm fuzzy]

4. at the time of recording the conveyance of the ROW happens, jurisdiction having authority takes fee simple ownership of the ROW and it is no longer taxed as personal property

5. road is built to whatever jurisdictional minimum standard (who is responsible for building the road - private party, jurisdiction or a combination?)

6. road is inspected to meet minimum standard and when it does it is accepted by the jurisdiction and will be maintained by the same

7. at time of acceptance of minimum standard construction road becomes a legitimate public roadCameron,

Here in Texas, plat dedication is usually in the form of an easement, not fee simple. Adjoiners on each side technically own out to the centerline of the right-of-way, unless the developer specifically retains ownership of rights-of-way per the Texas doctrine of strips and gores). Most cities want nothing to do with the fee ownership of roads.