Homeowner buys two lots in the 70's. The road runs north and south, and the lots are on the west side of the road and each have 100 feet of frontage and are 150 feet deep.

In about 1985 homeowner buys land immediately to the west, doubling the size of his lots.

In 2005 homeowner refinances his house and borrows $116,000.

Homeowner doesn't make his payments and the bank forcloses last month.

Now, here's where it gets interesting. The bank hires me to survey this property. After looking at the trustees deed I discover that all the bank owns is the "annexed" portion of the property, which is basically an open field BEHIND the lot with the house on it. Futher studying shows that was exactly what was in the original deed of trust.

Ruh Roh!

And still there are those who see no value in foundation inspections, "mortgage survey". Like any owner it is the banks obligation to know what it bought with that loan, they did not, tough luck.

jud

So, the bank does not even have access to that land.

Now, that if funny.

No better way to start the weekend...

... than a story about bankers getting the shaft.

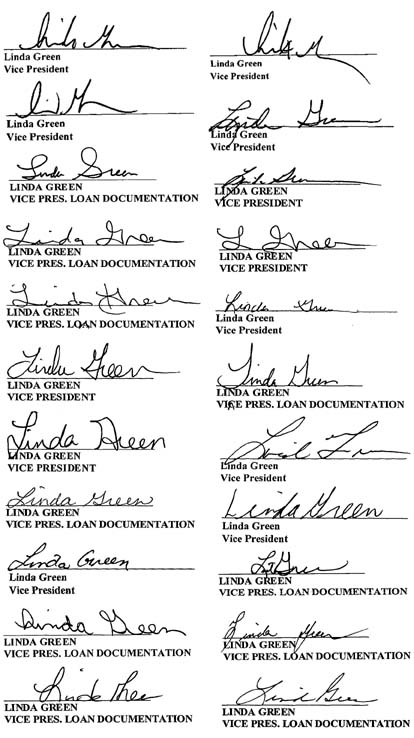

Then again, maybe the foreclosure documents were signed by Linda Green 😉

> ...Further studying shows that was exactly what was in the original deed of trust.

>

> Ruh Roh!

I'm a little confused. Which original D/T? The original in the 70's? or the original in the 80's when he bought the extra lots? But, wouldn't that make sense? Couldn't he have 2 D/T's? One for the house, and one for the lots? I'm sure you know what you are looking at, but something got lost in the translation... Sorry Tommy... It's Friday.

No better way to start the weekend...

> ... than a story about bankers getting the shaft.

>

> Then again, maybe the foreclosure documents were signed by Linda Green 😉

>

>

Wasn't she/that the one that was featured on 60 Minutes about the "Signature Mills" or whatever?

No better way to start the weekend...

> Wasn't she/that the one that was featured on 60 Minutes about the "Signature Mills" or whatever?

One and the same.

I've heard that in some areas the officials that oversee deed recordation (Registrar of Deeds, Clerk of the County Court, etc.) are reviewing all the previously recorded foreclosure documents to check the signatures and possibly pursue fraud charges against the banks.

No better way to start the weekend...

We have been asked by a legal firm working for our mortgage holder to sign papers which were"lost" from our last closing.

The asked us to sign forms which are supposed to be notarized and send in along with a copies of our drivers licenses......don't people EVER learn?

> > ...Further studying shows that was exactly what was in the original deed of trust.

> >

> > Ruh Roh!

>

> I'm a little confused. Which original D/T? The original in the 70's? or the original in the 80's when he bought the extra lots? But, wouldn't that make sense? Couldn't he have 2 D/T's? One for the house, and one for the lots? I'm sure you know what you are looking at, but something got lost in the translation... Sorry Tommy... It's Friday.

Sorry, the deed of trust from 2005.

No better way to start the weekend...

This is actually a pretty good bank. They've got a few branches, but none out of state, to my knowledge. It would be good if this would teach them to get a survey prior to loaning money, but I doubt it.

So, it's possible everybody thought he was refinancing his house including himself and the lender but somebody just copied the description of the westerly piece onto the 2005 D/T not really knowing what it described? Tough beans for the bank, I would think.

He still owes the bank the money. It may be a bunch of trouble for them to go to court and attach other assets (i.e. the house), and there may be other creditors to split it with, but I don't think they are flat out the money.

No, I don't think they are out the money either, but I don't see how they can foreclose on the house when the vacant property is what they loaned on. I suppose it could (and maybe will) be argued that the "intent" was clear from other supporting documents and the bank could end up with the house. As the lawyers say, it would depend on who their client is what the answer to that question is.

By the time my dad and I got there the next morning she was in a coma, I assume induced by massive doses of morphine that probably let her slip away quietly as we sat there.

On the other side of the coin, I once did a survey for a lady that owned three

lots, two of which her house was on(or so she thought). She quit paying taxes on the vacant lot and it went for tax sale. Yep, you guessed it. Half of her garage was on the "vacant" lot. To throw salt into the wound, her adjoining neighbor whom she despises, purchased it at tax sale and told her to move the garage.

That's not an encroachment, he just bought a lot and half interest in a garage.