Last year, I had a client who whose bank was requiring him to buy flood insurance. He did not want to buy flood insurance.

The FIRM map showed his house to be just within a Zone AE. I prepared an Elevation Certificate for him, and he was indeed a foot or two below the BFE, and still needs the flood insurance.

Now it has been well known since the flood maps were first published in 1988 that the flood plain for this particular stream was conservatively high. Earlier this year, the town had this entire stream recalculated, and FEMA issued a LOMR (complete with a new FIRM map) that just became effective a few days ago.

On the new FIRM map, there is a Zone AE on the property still (the property's border is the stream), but it is well clear of the house. There is a Zone X for the 500 year flood plain that approaches the house, but looks clear of it by 20 or 30 feet.

The client just contacted me asking for a LOMA for the house, which I'd be glad to do.

But does he need one? Can he just use the LOMR and its new FIRM map showing the house clear, or is the bank going to want a LOMA for the house?

Hmmm... I think I just answered my own question. Banks in this area have in the past required flood insurance if there was a mapped 100 year flood plain anywhere on the property, even if the house itself was clear. They will (usually) waive the flood insurance requirement for the house if a LOMA was issued (for just the house).

So it looks to me like my client will need a LOMA. Any opinions to the contrary?

If not, please excuse this post - I do talk to myself a lot lately!

I would probably submit it as a LOMA citing the new information, but only for the structure.

I would prepare a flood determination letter stating his structure is not in the SFHA. If the bank demands insurance he needs to fire them.

I would do an "Out as Shown" LOMA.

Bow Tie Surveyor, post: 332237, member: 6939 wrote: I would do an "Out as Shown" LOMA.

Why not start with a flood hazard letter? The map is already amended...

thebionicman, post: 332246, member: 8136 wrote: Why not start with a flood hazard letter? The map is already amended...

A flood hazard determination letter from FEMA is $80, the LOMA is free. The result is the same with the possible further benefit of avoiding the issue with lenders in the future.

A flood determination letter from you is whatever your rate is. The LOMA is already done in the form of a LOMR. You only need to do a LOMA OAS if there is a dispute.

thebionicman, post: 332270, member: 8136 wrote: A flood determination letter from you is whatever your rate is. The LOMA is already done in the form of a LOMR. You only need to do a LOMA OAS if there is a dispute.

Is a "flood determination letter" a FEMA thing, or just a letter that I write stating that the structure is not in the flood plain according to the new LOMR?

Googling has brought up a few references that state:

- Letters of Map Correction (i.e. LOMA's, LOMR's) are to be used only when the need for a map correction has been identified; not for flood zone determinations. Locating structures and related flood hazards and determining whether or not flood insurance is required are the sole responsibilities of the Lending Institution.

So I'm thinking that a letter from me saying basically "look at the new LOMR attached" may suffice?

Keep in mind a lender still may require flood insurance even with a LOMA. If they are going to lend money, the can almost ask for anything they want.

The flood determination letter is a FEMA form. Some lenders will accept a letter stating a particular structure is not in the SFHA.

Joe is correct. Lenders can ask for the moon. It is also true that unless you are seriously subprime you can fire them and go elsewhere..

We had an interesting call a few years ago. A lady had received a letter from her lender demanding that she purchase flood insurance. She had spoken with an agent and they wanted an elevation certificate so the underwriter could properly rate the policy. I pull up the flood map and her property is located more than 700 feet horizontally and 40 feet vertically from the nearest flooding source. It turns out that when FEMA publishes a revised FIRM that her lender does an audit of their existing loans in that area as a standard procedure. They hired an out of state flood determination company to look up the information. The only problem is they used Google Maps to plot the address which because of an error placed the property squarely in Flood Zone AE. We wrote a nice letter on our letterhead explaining what we feel occurred and highlighted the actual property on a firmette. I received a follow up call from her thanking us for helping clear things up for her.

David,

The scenario you describe is all too common. The 'flood determination specialist' companies are even taking it further. They are scanning the national flood hazard layer and alerting lenders of possible at risk homes. The problem comes in when they convince the banks our E-Cert is wrong and force a LOMA OAS. Completely out of control...

Dan B. Robison, post: 332313, member: 34 wrote: STANDARD FLOOD HAZARD DETERMINATION FORM (SFHDF)

DDSM:beer:

I saw that form, but I am confused - it looks like a form the lender should fill out, at least section I.

As a surveyor, would I just fill out section II and give it to the homeowner for him to pass on to his lender?

I suggest your client request his lender order the flood hazard determination. The lender will then contact a group like FloodCert. From what I understand these cost the lender about $25USD (or less depending on how many he orders). Or you can fill out section II and have the client give it to the lender. I have not found who is 'qualified' to fill out this form, but I've seen plenty filled out by CFM's.

Good Luck,

DDSM:beer:

Dan B. Robison, post: 332346, member: 34 wrote: I suggest your client request his lender order the flood hazard determination. The lender will then contact a group like FloodCert. From what I understand these cost the lender about $25USD (or less depending on how many he orders). Or you can fill out section II and have the client give it to the lender. I have not found who is 'qualified' to fill out this form, but I've seen plenty filled out by CFM's.

Good Luck,

DDSM:beer:

The problem with that idea is that most of the firm's doing it are using inadequate information. They will nearly always err on the side if caution. That may sound 'fair' but it is a gross abuse of the owners. FEMA does not publish approximate regulatory lines. The addition of a personal buffer is theft...

I just gave my Flood Cert to the local bank for a client and this is the response I got from the bank: "Thank you. CoreLogic provided an up-dated flood certification which shows the house being out of the flood zone." The bank is taking the word of a company in another state that is interpreting the flood map.

Terry_Jr, post: 332360, member: 5661 wrote: I just gave my Flood Cert to the local bank for a client and this is the response I got from the bank: "Thank you. CoreLogic provided an up-dated flood certification which shows the house being out of the flood zone." The bank is taking the word of a company in another state that is interpreting the flood map.

Well of course, they are the experts, after all. You really wouldn't expect a land surveyor to know how to read a map, would you?

Years ago my father walked into the local water/sewer department and asked to see such-and-such sewer map. The secretary told him "Oh no, we don't allow the public to see those. You wouldn't understand it anyway." My dad, the former town engineer, replied "But I drew those maps..."

Gromaticus, post: 332365, member: 597 wrote: Well of course, they are the experts, after all. You really wouldn't expect a land surveyor to know how to read a map, would you?

LOL...here is a link to the Master Index of FEMA Guidelines and Standards

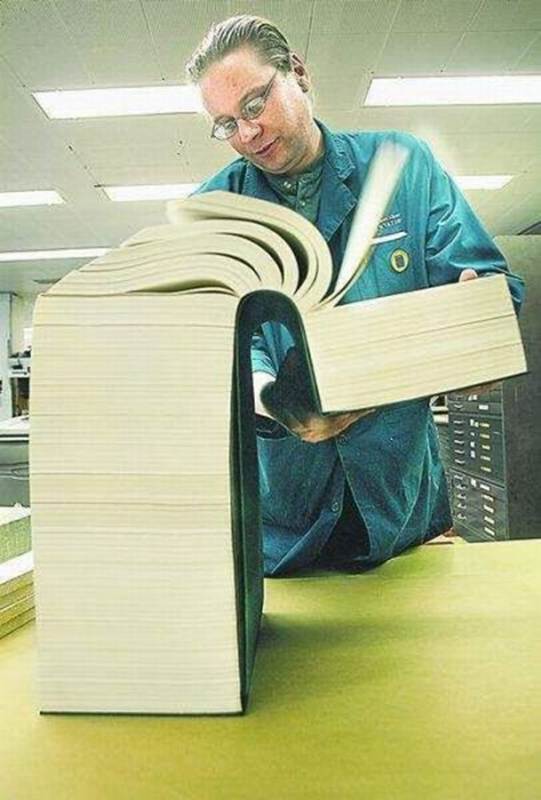

A picture is worth a thousand words:

DDSM:beer: